How IRS, AICPA, and FTC Rules Overlap in Outsourcing

Many CPA and accounting firms now need to outsource because it helps them grow and stay efficient. Firms might use offshore teams, hire external services, or work with specialists, but outsourcing offers more than just convenience. It helps firms manage growth and stay strong. At the same time, it brings challenges with following multiple rules and standards, not just one specific set.

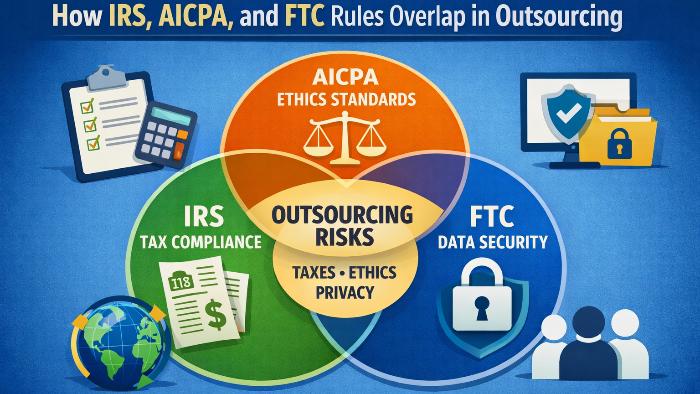

A big mistake that firms often make is seeing compliance tasks as separate and unrelated. They treat IRS requirements apart from professional ethics and think of data security as just an IT issue, not a regulatory one. In truth, outsourcing brings overlapping duties under IRS Section 7216, the AICPA Code of Professional Conduct, and the FTC Safeguards Rule.

This article looks at how these three frameworks connect, how outsourcing triggers all of them at once, and why CPA firms need integrated compliance when they outsource tasks.

IRS Rules: Consent and Using Tax Data

IRS Section 7216 controls how tax return preparers can use or share tax return details. It aims to keep taxpayers in charge of their private tax information and sets limits on sharing or using it beyond preparing taxes.

When a firm outsources work that involves accessing tax return details, Section 7216 comes into play. It focuses on two key issues:

• Does the process involve sharing or using tax return information?

• Was proper consent secured when needed?

Firms must get consent under Section 7216 before they disclose or use tax return information, and this consent has to follow specific rules about its content and format. Even if getting consent is not mandatory, firms still need to manage tax info and stay within allowed limits.

When it comes to outsourcing, the main point to understand is that any time a third party handles tax data, it must align with Section 7216 rules. Factors like where the work is done, how much it costs, or how efficient it might seem do not change this obligation.

AICPA Focus: Ethics, Confidentiality, and Supervision

The AICPA Code of Professional Conduct sets rules that guide CPA firms in providing services in an ethical way. Unlike the IRS guidelines, this Code covers more than just tax return details. It includes client relationships, professional decisions, and how services are carried out.

Outsourcing brings specific ethical guidelines into focus.

Confidentiality

The Code says firms must keep client details private and stop any unauthorized sharing. Sharing data with outside parties raises confidentiality issues that need to be handled with proper protections, openness, and sometimes approval from the client.

Supervision and Review

The Code says firms must plan, oversee, and check professional services. Hiring outside help does not change this responsibility. Companies need to stay in charge of how tasks are done, reviewed, and completed.

Due Care and Professional Responsibility

Due care means firms have to make sure services are done and meet professional rules. They cannot shift responsibility for work to someone else. Firms are still in charge of quality and ethical standards.

The AICPA framework points out that outsourcing shares tasks but not accountability.

FTC Focus: Data Security and Vendor Oversight

The FTC Safeguards Rule, under the Gramm-Leach-Bliley Act, aims to protect customer data by requiring security measures. Since CPA and accounting firms deal with private financial and personal data, they must follow these regulations.

When firms outsource tasks, third-party companies get access to sensitive customer data. This creates certain responsibilities:

• Firms must choose vendors who can protect this data.

• Contracts must include terms that ensure data safety.

• Firms need to review vendors’ performance and evaluate risks.

• Being prepared for incidents is also a requirement.

The FTC checks if a company has an organized security program that uses administrative, technical, and physical protections. Handing over tasks to others adds more risk, so keeping a close watch on vendors plays a major role in meeting these rules.

Can your firm complete the FTC Safeguards Rule checklist? Read to know more.

How Outsourcing Triggers All Three Frameworks

Outsourcing connects the rules of the IRS, AICPA, and FTC.

When someone outside the firm handles client data:

• IRS Section 7216 comes into play if the data involves tax returns

• AICPA's rules about confidentiality and oversight apply to any professional service

• FTC Safeguards Rule sets standards for protecting customer information

Each of these focuses on different concerns, but they overlap in practice. One outsourcing choice can touch on consent, ethics, supervision, and data safety all at once.

For instance:

• Letting an offshore team handle tax details may need IRS consent

• That same access must meet AICPA guidelines on privacy and oversight

• It also requires following FTC rules for security and vendor management

When obligations are handled, gaps can arise that regulators and professional organizations notice.

Why Integrated Compliance Matters

Integrated compliance focuses on creating outsourcing models that meet IRS, AICPA, and FTC standards all at once instead of treating them.

Avoiding Fragmented Controls

If firms tackle each framework on its own, they often end up with incomplete solutions. They might collect consent but not secure data. Security measures might be in place, but oversight could be lacking. Ethical guidelines could be mentioned, but there might not be proof of them.

Integrated compliance brings together:

• Consent processes

• Measures to protect confidentiality

• Oversight and review methods

• Security programs and vendor management

Streamlining Operations

Integrated compliance enables firms to maintain steady practices across various service areas. Teams can use the same set of governance rules for both individual and business tasks, local and international groups, as well as frequent and one-time projects.

This steadiness helps minimize confusion, reduce training effort, and lower compliance risk.

Defensibility

From a regulatory perspective, firms find it easier to defend integrated compliance. They can show proof that outsourcing choices were reviewed as a whole, taking into account consent, ethics, and security all together.

As firms formalize outsourcing governance, they often rely on documented due diligence covering confidentiality obligations, data security controls, contractual safeguards, and regulator-ready oversight practices. MYCPE ONE is an offshore services organization working with CPA and accounting firms for over a decade, with experience across more than one thousand firms, and has compliance resources available that address consent, confidentiality, and data protection requirements under IRS, AICPA, and FTC frameworks.

Resources:

A Complete Guide to IRS 7216, AICPA, and FTC Requirements View here

Due Diligence Checklist View here

Virtual Event: Update on IRS 7216, AICPA and FTC Requirements View here

Conclusion

Outsourcing does not follow just one set of rules. It combines IRS consent rules, AICPA ethics, and FTC data safety standards.

Firms that understand how these guidelines overlap can create outsourcing strategies that meet all regulations. This integrated approach lowers risk, makes operations clearer, and builds stronger trust with clients.

As outsourcing grows and changes, businesses need to handle compliance as one cohesive system instead of splitting it into multiple separate tasks.

Key Points

• IRS Section 7216 applies to consent and use of tax return data.

• AICPA rules highlight ethics, confidentiality, oversight, and responsibility.

• The FTC Safeguards Rule focuses on data protection and managing vendors.

• Outsourcing triggers all three regulatory areas at once.

• Fragmented compliance creates risk

• Integrated compliance supports defensibility and scalability

FAQs

Do rules from the IRS, AICPA, and FTC function together?

They work on their own but often get triggered together in outsourcing situations. Each framework handles unique risks, and companies need to follow all rules that apply when third parties deal with client information.

Can IRS Section 7216 consent meet AICPA or FTC requirements?

No, it cannot. Consent deals with sharing and using tax return details, but it does not take the place of ethical duties required by the AICPA Code or the security rules set by the FTC Safeguards Rule. Every framework comes with its own set of obligations.

Does location impact how these rules are applied?

Location does not decide how these rules work. These rules emphasize control, access, and protection measures over the physical location. The same standards apply to outsourcing within the country or abroad.

Can firms handle compliance by focusing on one framework at a time?

Managing frameworks one at a time often creates problems. Combining compliance efforts helps align consent, ethics, supervision, and security. It makes sure these elements are applied across different outsourcing methods.

Why is vendor oversight a major focus in all three frameworks?

Vendor oversight protects consent reliability, maintains confidentiality, and keeps data secure. Without proper oversight, companies fail to show they meet the standards of the IRS, AICPA, or FTC regulations.

Share This Article

What's Trending?

Trending topics & tools for the CPA community

How Firms are Rethinking Reasonable Comp (Quick Video)

It’s a short video and makes the value of repeatable, data-backed approach clear (especially compared to spreadsheets, gut checks and one-off calculations).

Learn how 8am CPACharge delivers clarity and confidence for accounting firms.

8am™ CPACharge brings invoices, payments, and reconciliation together in a solution designed to make your day easier from start to finish.

Seniors on Social Security Could Face $460 Monthly Cut to Benefits

Jim Komoroski, RSSA®, is quoted in Newsweek, offering expert insight into the projected monthly cuts to Social Security benefits should Congress fail to act.

Resources

Valuable information provided by our sponsors.

Specialize in Social Security

Looking to enhance your retirement planning expertise? Your solution: pursue the Registered Social Security Analyst®...

CPAdirectory members have access to discounted auto and home insurance

At CPAdirectory, we think it's a good thing to provide our members with access to...

Free CPE Course: ChatGPT for Tax Pros — Limited Offer

CPAdirectory and CCH CPELink are giving you free access to the on-demand course: ChatGPT for...

PE Deals In Accounting: Valuations, Structure, Tradeoffs

In this webinar, you’ll hear from firm leaders and industry experts who will share real-world...

Stand Out as a Trusted Social Security Expert with the RSSA® Designation

Designed for CPAs, the Registered Social Security Analyst® (RSSA®) designation provides advanced training to help...

How Firms are Rethinking Reasonable Comp (Quick Video)

It’s a short video and makes the value of repeatable, data-backed approach clear (especially compared...