News & Articles

Recent updates and the latest guidance for the CPA Profession

Stand Out as a Trusted Social Security Expert with the RSSA® Designation

Designed for CPAs, the RSSA® designation provides advanced training to help clients optimize Social Security benefits as part of comprehensive tax and retirement planning.

Learn MoreSponsored by: Kaplan

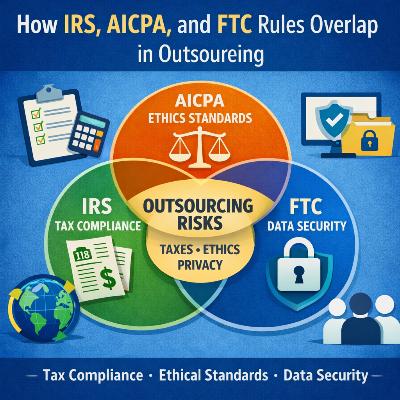

How IRS, AICPA, and FTC Rules Overlap in Outsourcing

MYCPE ONE | February 17, 2026Many CPA and accounting firms now need to outsource because it helps them grow and stay efficient. Firms might use offshore teams, hire external services,......

Read More...

MYCPE ONE Launches Learning & Development Services for CPA and Accounting Firms

MYCPE ONE | February 10, 2026As accounting firms face mounting pressure from regulatory changes, evolving client expectations and rapid technological shifts, MYCPE ONE announces the launch of its dedicated Learning......

Read More...

MYCPE ONE Launches AI-Powered Assessment Platform for CPA and Accounting Firms

MYCPE ONE | January 20, 2026MYCPE ONE Assessments are created exclusively for CPA and accounting firms, with a focus on job relevance, practical evaluation, and role clarity. Each assessment is......

Read More...

Top Offshore Accounting Firms: Trusted by CPA & Accounting Firms

MYCPE ONE | January 19, 2026Outsourcing to India presents a compelling solution that can save up to 75% compared to local hiring. Firms get access to one of the world's......

Read More...

MYCPE ONE Launches AI CPE Academy for Accounting Professionals

MYCPE ONE | January 06, 2026December 2025 – MYCPE ONE, a trusted CPE platform for accounting and finance experts, today announced the launch of its AI CPE Academy. The advanced......

Read More...

5 Best CIA CPE Providers for Internal Auditors

MYCPE ONE | December 01, 2025If you’re a Certified Internal Auditor (CIA) looking to meet your Continuing Professional Education (CPE) requirements, choosing the right CIA CPE provider can make all......

Read More...

Best CPE Providers to Find the Right Fit for Your CPA Needs

MYCPE ONE | October 17, 2025Finding the right CPE providers for your accounting career might seem daunting. The market has roughly 2,050 continuing education options as of March 2023. Becker......

Read More...

7 Continuing Education Mistakes Professionals Make and How to Avoid Them

MYCPE ONE | October 05, 2025Professionals often make continuing education mistakes by skipping clear goals, procrastinating, repeating familiar topics, ignoring rules, avoiding online options, choosing poor programs, or treating it......

Read More...

Best CPE Providers for CPAs: An Expert's Honest Review

MYCPE ONE | August 20, 2025CPAs spend over 40 hours a year searching for CPE courses that fit their career goals. A 2024 AICPA survey found that 78% of accountants......

Read More...

The Ultimate Guide to Outsourced Accounting Services: Transform Your Financial Operations in 2025

MYCPE ONE | July 21, 2025Outsourced accounting is no longer just a cost-cutting measure—it’s a strategic move that empowers businesses with expertise, scalability, and cutting-edge technology. With the outsourced accounting......

Read More...